The fact is that the American health care system is in a state of constant flux. The state of healthcare necessitates a discussion of Medicare vs private insurance in New York and beyond.

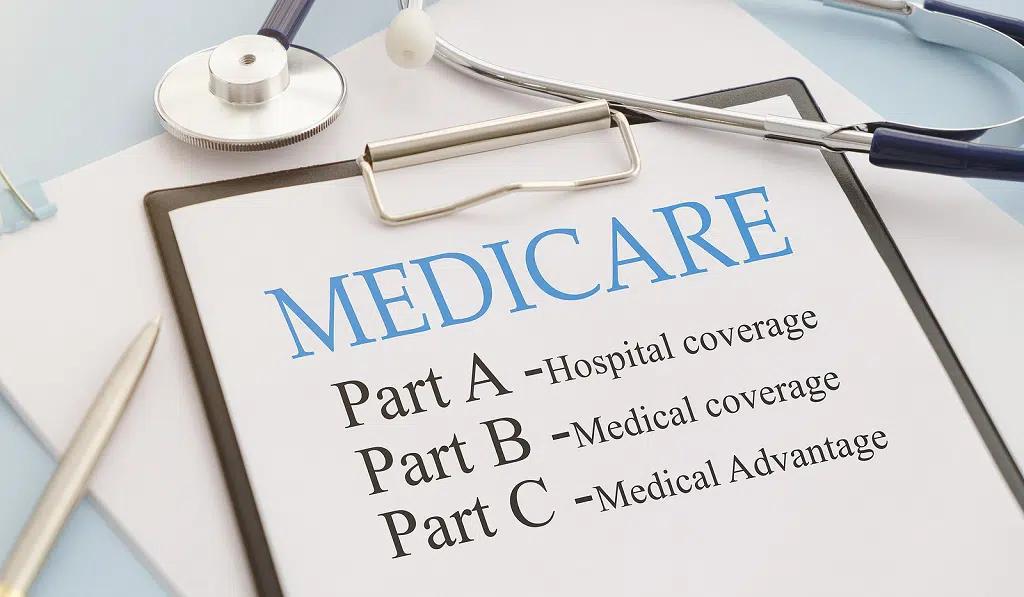

The Medicare program was created to cover senior citizens and disabled persons in the United States. Medicare is individual health insurance. There are no family plans or spousal coverage available. Each insured person must qualify for Medicare benefits individually. Therefore combined premiums for a qualifying family may be much higher than a private insurance family plan.

But what exactly is Medicare, and why should you consider it if you are eligible? Here are some essential points to consider before deciding between Medicaid and private insurance in New York.

Medicare Advantage Plans

A Medicare Advantage Plan may provide more coverage at a lower cost than traditional Medicare for many seniors. However, it’s important to note that Medicare Advantage Plans typically have higher out-of-pocket costs than regular Medicare. Many of these plans also have high deductibles and co-pays.

However, if you’re interested in signing up for a Medicare Advantage Plan, it’s essential to understand all the options available. There are several different Medicare Advantage plans: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-service Plan, or Part C Indemnity plan with drug benefits.

Because each type of Medicare Advantage Plan varies so much, it can help to look into what’s available in your area before deciding which health plan best suits your needs.

Private Health Insurance

Health insurance options are numerous in New York, with different companies offering various plans. However, it’s important to consider two major factors when choosing a plan: the type of coverage and the provider.

The first question to ask yourself is whether or not you want private health insurance. If so, who do you want your provider to be? There are many advantages and disadvantages to both Medicare and private health insurance; it’s up to you which one best fits your specific needs.

In New York, private health insurance is often less expensive than Medicare, but premiums can be high if you already have a preexisting condition. On average, out-of-pocket expenses are much lower for those with Medicare; however, a deductible must still be met each year before Medicare will kick in.

Medicare vs Private Insurance in New York Premiums

In a general comparison of the cost of Medicare and private insurance, the cost of Medicare plans in 2022 and the average monthly premiums for private insurance in 2021 show that, although premiums are lower for Medicare plans, private insurance may be the wisest choice for families.

Medicare vs Private Insurance Out-of-Pocket Maximums

There are differences between Medicare and private insurance plans regarding out-of-pocket maximums. For example, Medicare Part A has no additional premium, and its annual deductible is $1,484 in 2021. Its maximum out-of-pocket amounts vary from place to place but are typically around $6,700 per year. Medicare vs. Private Insurance Out-of-pocket Maximums

Medicare Part B has a monthly premium of approximately $148.50 In 2021. Its deductible varies by plan, and some may not require any at all, while others charge as much as $415 each time they see a doctor or go into a hospital.

Part B’s out-of-pocket max can’t be more than $8,700 for an individual and $17,400 for a family. This amount doesn’t include premiums or deductibles. Part D’s prescription drug plans also carried an out-of-pocket limit of $4,130 in 2021. The limit applies across multiple prescriptions, so you don’t pay extra if you get several types of medicine.

Frequently Asked Questions

What are the cost differences?

Private insurance premiums vary, depending on the age, location, and type of coverage. High deductible plans usually cost less per month than low deductibles. Insurance companies cover the costs by different people contributing to their health care before additional funding. On the flip side, Medicare plans are more expensive since the plan doesn’t have an out-of-pocket limit,

Which is better for those with dependents?

Depending on the situation, it might be a good idea to go with private insurance. While Medicare does cover things like doctor’s visits and hospital care, it doesn’t cover everything. For example, if you have dependents requiring extensive medical attention, Medicare will only cover those who qualify under their own Medicare policy. Private insurance may be a better option.

In addition to covering more costs associated with medical treatment, private insurance tends to come with additional benefits not covered by Medicare, including vision and dental coverage. This is one of several reasons why it’s important to get detailed quotes before selecting a Medicare plan.

One point to keep in mind when deciding which type of coverage to choose is that Medicare does not cover supplemental benefits such as hearing aids, eyeglasses, dental coverage, or massage therapy.

Therefore Medicare might not be best if these types of things are important to you. On a similar note, Medicare has a higher co-pay requirement for services that it does cover. So, for example, a physician’s visit would have a 20% coop charge versus a 10% coop charge under a private insurance plan.

Is private insurance better than Medicaid?

In New York, both Medicaid and private insurance are required to cover all of the services that Medicare covers. However, there’s a significant difference between what you’ll pay out of pocket, whether or not you get help paying your premiums (which Medicare does not provide), and how much coverage changes based on your individual needs.

What is the difference between Medicare and non-Medicare insurance?

Most people don’t know that Medicare, a federal insurance program, and private insurance are two distinct types of health insurance. There are essential differences between Medicare and non-Medicare policies that can impact your premiums, coverage, and out-of-pocket costs.

The Medicare system provides federally funded health care to eligible individuals aged 65 or older, younger individuals with disabilities, and/or End-stage Renal Disease (ESRD). It also covers younger individuals who have become disabled due to their work.

On the flip side, Non-Medicare coverage is a notice that tells a person when health care from a home health agency (HHA), comprehensive outpatient rehabilitation facility (CORF) is ending and the necessary steps to get in touch with a Quality Improvement Organization (QIO) to appeal.

What does Medicare cost in NY?

For individuals who pay Medicare taxes for 39 quarters, part A premium will cost $274 in 2022. However, various programs help Medicare beneficiaries pay their out-of-pocket costs, including deductibles and copayments. In addition, the federal government pays monthly premiums for about two-thirds of all Medicare recipients based on income and other factors.

What are some drawbacks to having private health insurance?

Although having private health insurance may seem like a good idea, some drawbacks are considered. For example, many Medicare plans have set lists of healthcare providers that they approve. If your doctor isn’t on one of these lists, you may end up having to pay out of pocket to use him or her.

Another drawback—and perhaps most frustrating—is that you may be refused service if you don’t choose a provider on a plan’s list and need medical attention urgently. Additionally, choosing a private insurance company doesn’t guarantee coverage in all care areas.

In New York, for instance, Medicare does not cover dental services unless you purchase additional coverage; in Pennsylvania, it doesn’t provide vision care at all.

Making Your Decision

All in all, there isn’t a definitive answer to Medicare vs private insurance in New York. Each option has its pros and cons, but ultimately it comes down to your needs. You may even want to look into both policies simultaneously so that when one becomes too expensive (or unnecessary), you’ll have a backup plan that fits your situation perfectly.

If you aren’t sure which option would be best for you, consult the professionals at Charles Newman Co., who can explain each policy in detail and help you make an informed decision. You can request information using our online Contact Form or phoning our Peekskill office at 914-690-7516. Our insurance specialists are eager to help.